Financing urban development: How innovative financial mechanisms can address the challenges facing EU cities

A new study offers fresh insights into how cities around the European Union are turning to innovative financial schemes (IFS) as new ways to mobilise, distribute, and govern funds more effectively. It draws insights from the assessment of 11 cities that received funding from the Urban Innovative Action (UIA) and designed and implemented IFS as part of their projects. The study highlights the diverse range of schemes implemented—including innovative procurement, revolving funds, community land trusts, and local virtual currencies—demonstrating the flexibility and potential of IFS in tackling urban challenges, such as encouraging sustainable behaviour by tracking and rewarding it, crowdsourcing governmental tasks, involving companies in job seeker training, and funding social projects. For a more in-depth understanding of the different types of IFS, an inception report has been published, offering a detailed background on their development and application.

Key features of IFS

The study highlights that IFS offer an alternative to traditional governance structures, testing new ways for municipal authorities and local stakeholders to collaborate on urban development projects and promoting more participatory and inclusive decision-making. In many of the examined projects, the design and implementation of IFS led to a shift in the way the municipalities viewed project financing, moving beyond conventional funding models and thinking more creatively about resource mobilisation and project implementation.

While IFS can vary in structure and implementation, they share several common features. The study shows that IFS are often developed and executed by large consortia composed of diverse stakeholders -including municipalities, NGOs, academic institutions, private companies, and national agencies. This collaborative approach enables cities to leverage diverse expertise and resources, helping them overcome financial and human resource constraints. Many IFS also integrate digital tools and require a prioritisation of citizen engagement and extensive and effective communication.

Enabling conditions for IFS implementation

The study identifies several factors that contribute to the successful implementation of IFS. These enabling conditions vary depending on the type of scheme, sector focus, and local context, as different projects often require tailored technical expertise and specific legal frameworks. However, certain common enablers emerge.

Among these, institutional capacity plays a fundamental role, as municipalities must have the administrative and financial capability to manage complex funding mechanisms. Technical expertise is equally important, particularly for sector-specific projects that demand specialised knowledge in areas such as finance, legal compliance, and digital innovation.

Strong partnerships between municipalities, private sector entities, NGOs, and academic institutions help leverage diverse skills and resources while fostering a collaborative approach to project development. Political support is another key factor, ensuring long-term commitment and policy alignment, while co-creation and citizen engagement enhance public trust and participation, making projects more responsive to local needs. Finally, cross-departmental collaboration within municipal administrations is essential for integrating IFS into broader urban strategies, breaking down silos, and improving coordination across different policy areas.

By strengthening these enabling conditions, cities can create a more supportive environment for developing and scaling innovative financial schemes, ultimately driving more effective and sustainable urban development.

Barriers to be mindful of when implementing IFS

While cities are open to testing new innovative solutions, the study highlights potential challenges and barriers they may face. These barriers stem from both internal barriers within municipal administrations and external barriers in the broader environment, which may not always support innovative financial schemes.

One of the most commonly cited barriers is the presence of regulatory hurdles. Existing legal frameworks may not align with new financial models, creating compliance challenges that can slow down or even prevent the adoption of IFS. Navigating complex regulations requires time, expertise, and often legal adjustments.

Another key challenge is the technical complexity of IFS. Public authorities may lack the specialised financial, legal, or technological expertise required to design, implement, and manage these schemes effectively.

Key takeaways for cities considering implementing IFS

The study provides some recommendations for cities considering designing and implementing IFS of their own. Notably:

- Cities would benefit from setting up dedicated multidisciplinary teams that are open to experimentation. As mentioned above, some IFS involve a significant element of technical complexity, while others face regulatory hurdles due to their novelty pointing to the need for technically skilled experts and solid legal expertise. Similarly, involvement of communication and community engagement experts, as well as the so-called “financial architects”, who can put together complex financial strategies, build partnerships with stakeholders and champion innovative funding, is also recommended for the successful design and implementation of any IFS.

- Importantly, cities should adapt the funding source to the IFS itself. For revenue-generating IFS (e.g. used for energy efficiency upgrades or urban regeneration), cities can leverage commercial finance and EU financial instruments that require repayment, allowing them to maintain a sustainable funding model. Other investors could include pension funds and insurance companies. For non-revenue generating IFS (e.g. used to encourage sustainable behaviour), authorities could consider social impact funds, where returns are based on measurable outcomes.

- Cities are also encouraged to build partnerships and leverage synergies with diverse local stakeholders to pool resources and expertise together.

- It is important to keep in mind that it is not always necessary to start from scratch. Cities can build on existing platforms and use tools developed by others. They can also learn from best practices and engage with cities that have implemented similar IFS.

- Generally, aligning IFS with local strategies and policies was also found to be important for building momentum and gaining political buy-in.

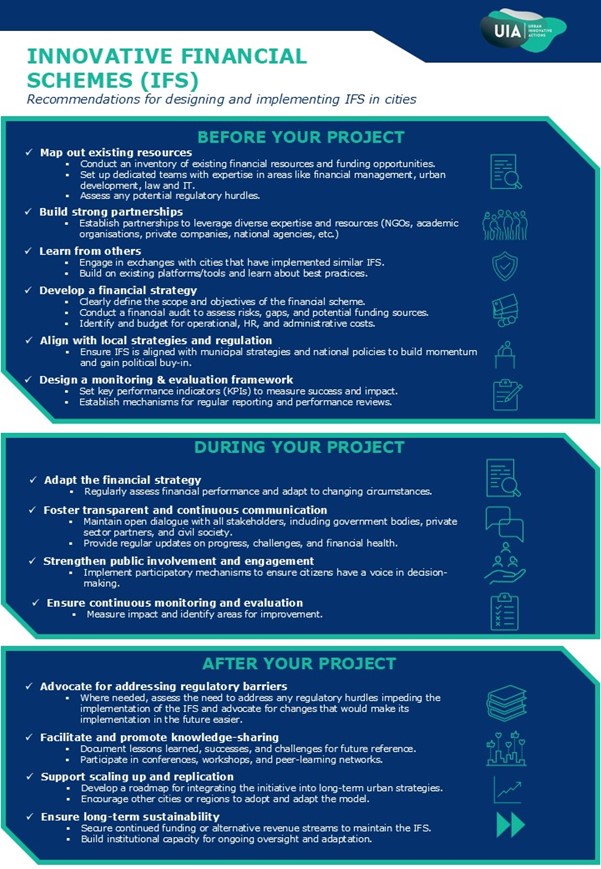

A full list of recommendations is presented in the figure below.

Full list of recommendations

Exploring new innovative financial models is not only a necessity, but an opportunity. As cities continue to face mounting challenges and budget constraints, success will increasingly depend on their ability to create, deploy, and scale innovative financial schemes. This study contributes to the emerging understanding of how cities can leverage innovative finance to address urban challenges, offering insights for policymakers and urban practitioners committed to driving sustainable and inclusive urban transformation.

Access the full report here.