7.5.1 Use of the euro and exchange rates

All financial budgeting, reporting and project follow-up will be in euro. This means that expenditure must be budgeted in the Application Form and reported to the Permanent Secretariat in euro, and that all ERDF payments will be made in euro.

Project Partners located outside the euro zone will report expenditures in their national currency, which will be automatically converted into euro by the EEP upon submission of the claim, based on the exchange rate of the European Commission applicable in the month the documents are submitted to the FLC for verification on the EEP.

For Project Partners located inside the Euro zone and incurring expenditure in another currency than euro, these expenditures must be reported in that currency, which will be automatically converted into euro by the EEP upon submission of the claim, based on the exchange rate of the European Commission applicable in the month the documents are submitted to the FLC for verification on the EEP.

7.5.2 Revenues

Any potential revenues or net revenues generated by project activities do not have to be deducted from the project budget, as long as they are used to cover the operation and/or maintenance costs of project investments and contributing to the financial self-sustainability of the proposed innovative solutions, the continuation and/or scaling -up of activities beyond the project lifespan.

7.5.3 Project partner contribution

As stated in the funding principles, the EUI-IA projects follow the “total costs” principle: a project is co-financed by the ERDF up to 80% of the total eligible costs, and each Project Partner (MUA or AUA, Delivery Partner and Transfer Partner) receiving ERDF must secure a financial contribution to complete its budget up to the contribution target (20% of the Partner eligible costs at least).

Project Partner contributions to a project can be secured with:

- Public or private resources (but in any case, not from another EU funding source).

- Project Partner’s own resources or external resources (i.e. covered with resources from an entity external to the Partnership, or from another Project Partner[2]). The source of the contribution must be clearly stated in the Project Partner’s contribution section of the Application Form.

- Cash or in-kind:

- Contributions in cash refer to contributions paid to the project by the Project Partners. In that respect, own Project Partner staff costs provided to projects must be considered as in cash contribution (salaries are paid monthly by the employer to the employees).

- In-kind contribution refers to non-cash contributions given to a project that have a monetary value, however for which it is not charged, and for which no cash payment supported by invoices or documents of equivalent probative value has been made.

In-kind contributions

Eligible in-kind contribution can be goods, staff (volunteers only), land and real estate, equipment, studies, services or rents under the framework of the EUI-IA. They must be necessary to carry out the tasks and achieve the project objectives agreed by the Project Partners.

In-kind contributions may be eligible provided specific conditions are met:

- The public support paid to the project which includes in-kind contributions does not exceed the total eligible expenditure, excluding in-kind contributions, at the end of the project.

- They comply with the applicable EU rules and do not contravene national rules.

- The value of contribution must be in line with the current open market value.

- The value of the contribution must be certified by an independent qualified expert or duly authorised official body/person.

- Contributions were not previously paid for or co-financed by EU funds.

- The provision of land as contribution is limited to 10% of the total project budget[3].

- The provision of staff as contribution for volunteering work is defined as work carried out for the benefit of the project without receiving any financial compensation for it (i.e. cannot be part of the paid assignments of the volunteers, cannot be assigned to employees receiving remuneration from a project partner or any other organisation, cannot be covered by scholarship fees…). Additionally, unpaid work should have a specific purpose contributing to the content of the project activities and should be limited to a certain time period. Unpaid workers must have the following documentation available: a signed agreement between the volunteer and the organisation specifying the duration and conditions of the unpaid work; signed time sheets indicating the time spent by the volunteer on the project. Project Partners can report cost of unpaid voluntary work only up to the level of their own contribution.

- In-kind contributions are eligible only if they are included in the approved Application Form.

In-kind contribution must be reflected in two different sections of the Application Form: the Partner Contribution section and the project budget in the Work Plan[4] as they are considered as Project Partner expenditure. In-kind contribution can be budgeted and declared in the following cost categories:

- External expertise and services.

- Equipment.

- Infrastructure and construction works.

When reported, in-kind contribution shall be validated by the project designated FLC like any other project expenditure. The Project Partner having declared in-kind contribution bears full responsibility towards all detected irregularities (even if the final source of the contribution is external to the project partnership). In case the source of in-kind contribution is external, the beneficiary responsible for receiving the contribution shall establish a written agreement with the organisation providing the contribution. The agreement should at least cover the availability of all original documents supporting the reality of the contribution, the transfer of ownership and the certification of its value.

[2] For instance, the MUA (or any other Project Partner) can cover part or the full amount of the contribution of another Project Partner with less financial capacity.

[3] Regulation (EU) 2021/1060, Article 64 (b).

[4] For instance: a derelict building valued at EUR 100,000 is “given” to a project as in-kind contribution by Project Partner X to be refurbished and used for project activities. The Application Form should show EUR 100,000 as in-kind contribution of Project Partner X in the Partner contribution section and budgeted in the relevant Work Package budget.

7.5.4 Budget flexibility

In order to leave some flexibility in the way the project budget estimated in the Application Form is actually spent during the project lifetime, projects are allowed to:

- Carry out, within the limit of 25%, any modification of the budget of any Work Packages at project level and reallocation to (an)other Work Packages(s) without the prior approval of the Permanent Secretariat.

- Overspend by a maximum of 25% or EUR 25 000 (whichever is more favourable to the project) the budget of any Project Partner or cost categories at project level, without prior approval of the Permanent Secretariat. In case an overspending of more than 25% is foreseen for any Project Partner or cost category at project level, then a duly justified request must be submitted for prior approval to the Permanent Secretariat (see Chapter 6.2 “Project changes”).

No underspending level (including by more than 25%) require any approval of the Permanent Secretariat.

In any case, the originally approved ERDF funding cannot be exceeded.

7.5.5 Ownership and durability

To ensure the sustainability of the project investments after the end of the EUI-IA project and to avoid the ERDF grant producing any undue advantage, specific rules on ownership and durability must be observed for each investment in infrastructure or productive investment[5] co-financed from the project.

This rule applies to both project infrastructures and works and project investments equipment.

Ownership

Only Project Partners can become owners of the project investments. Ownership of outputs having the character of investments in infrastructure or productive investments realised within the project must remain within the Project Partnership and the related Project Partners for at least 5 years following the final payment to the MUA.

Furthermore, and as a guiding principle of serving the general interest with the ERDF public funding, project outputs (e.g. processes leading to new products or services, studies, policy recommendations, good practice guides) are expected to be freely available for the public. In exceptional cases, Project Partnerships might have good reasons to protect their project deliverables and outputs. These cases must be included in Section G of the Application Form ”Risk management”, and Projects Partners should make use of the Partnership Agreement to make the necessary provisions for questions on ownership and Intellectual Property Rights[6].

Durability

All investment in infrastructure or productive investment co-financed from the project budget must remain operational and continue to serve their purpose for a certain period to ensure the project durability. Within the 5 years of the final payment to the project, any substantial modifications occurring in the form of any of the following situations, would result in a violation of rules concerning durability[7]:

- a cessation of operation;

- a transfer of a productive activity outside the NUTS level 2 region in which it received support;

- a change in ownership of an item of infrastructure which gives to a firm or a public body an undue advantage;

- a substantial change affecting the nature, objectives, or implementation conditions of the investment which would result in the undermining of its original objective.

Likewise, if project investments are unfinished at the end date of the Thematic Work Packages in a way that would prevent the project achieving its original objectives and investments durability and sustainability, the MUA is responsible for completing them at own costs, between the end date of the Thematic Work Packages and the end of the project Closure Phase. Should the investments not be completed after this acceptable timeframe, the Entrusted Entity may recover all or part of the unduly paid ERDF support. Durability and sustainability are considered undermined whenever the non-completion of an investment prevents it to be used and/ or used for the purpose foreseen in the Application Form.

The MUA and Project Partners must inform the Permanent Secretariat / Entrusted Entity where any of the above conditions on ownership and durability are not met within the 5 years period of the final payment to the project. Where the Project Partner does not comply with the above requirements, the Permanent Secretariat will request recovery of unduly paid ERDF subsidies (see Chapter 7.7 “Recovery of European Regional Development Funds”). For the calculation of the irregular amount the Permanent Secretariat considers the total co-financing provided for the investment, the period during which the investment was used in line with the Initiative rules and the period in which it did not comply. The periods of compliance and noncompliance will be set in proportion to establish the financial irregularity and the repayment amount. Likewise, should there be no information for the non-completion of the unfinished investments or due justification mitigating the impact on project durability, unduly paid sums may also be recovered by the EUI.

[5] A productive investment should be understood as investment in fixed capital or immaterial assets of enterprises, with a view to producing goods and services and thereby contributing to gross capital formation and employment.

[6] For more information about IPR, applicants can consult the EU IPR helpdesk: www.iprhelpdesk.eu

[7] Regulation (EU) 2021/1060, Article 65(1)

7.5.6 Procurement

7.5.6.1 Public procurement

Project Partners who fulfil the definition of a contracting authority according to the relevant national procurement legislation must respect the public procurement rules.

These rules aim at ensuring that the purchase of services, goods and works follows transparent procedures and that fair conditions of competition for suppliers are provided. EUI-IA projects must obey the applicable public procurement rules. Thus, any purchase of goods, services, or public works for the implementation of a EUI-IA project must be carried out in line with the relevant public procurement rules.

Project Partners must follow the requirements for procurement set in EU rules, national legislation and EUI-IA rules. The procurement rules apply to the project expenditures reported under real cost:

- External expertise and service costs.

- Equipment.

- Infrastructure and works.

Please note that costs covered by the simplified cost options (lump sum, flat rate or standard unit cost for staff) might be also subject to public procurement rules due to national legislation or internal rules.

Public procurement rules foresee different kinds of procurement procedures. In general, the higher the value of a contract to be awarded, the stricter the procurement rules that must be complied with. Notably, the value of the contract determines the range of the publicity required for the respective procurement, either an EU wide tender or a national level tender.

The EU has set up minimum requirements for public procurement[8]. Considering the nature of the activities performed in EUI-IA projects, the main reference document on EU public procurement rules is the directive on public contracts for the acquisition of services, supplies and works, i.e.:

- Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on public procurement.

- Directive 2014/23/EU of the European Parliament and of the Council of 26 February 2014 on the award of concession contracts.

The procurement directive applies to purchases whose estimated value (VAT excluded) is equal to or above certain thresholds[9]:

For contracts with an estimated value below these EU thresholds, Project Partners must respect the principles of the Treaty if their contract presents a certain cross-border interest. In other cases, they apply a corresponding national (regional, local, or institutional) procedure. In case stricter rules are applicable according to any of these regulatory frameworks, the strictest of the applicable procurement rules applies.

The procurement process requires thorough documentation for audit trail purposes and transparency of the decision-making process, as well as equal treatment of all potential contractors. The adherence to public procurement procedures must be well documented, even for procurement contracts pre-existing the EUI-IA project and used for the project activities. Documents such as public procurement notes, evaluation process, terms of reference, offers, order forms and contracts must be available for financial control and audit purposes. It should be noted that even below the EU thresholds, the fundamental principles of public procurement still apply: transparency, effective competition, non-discrimination and equal treatment. Thus, even where national public procurement rules allow for direct contracting for small contract values, the selection procedure has to be documented (e.g. proof of market research, documents tracing the selection of an operator and the awarding of a contract) and the observance of the principles of economic and efficient use of funds have to be proved. Therefore, it is recommended that, even where direct awarding is allowed, Project Partners still request offers from different providers or provide evidence of adequate market search before selecting one provider to ensure an adequate level of transparency and of economical use of public funds.

In-house contracting

The in-house contracting is the contractual relationships established between a public authority willing to purchase services/goods/works and a provider (legal person governed by private or public law) which is fully owned and/or under the control of this authority (administrative control, control in terms of the activities performed and financial control). This control may be exercised directly by a single contracting authority or jointly with other contracting authorities.

These contracts fall outside the scope of public procurement[10] if all the following conditions are fulfilled:

- The contracting authority exercises over the provider a control which is similar to the control exercised over its own departments.

- More than 80% of the activities of this provider are carried out in the performance of tasks entrusted by the controlling contracting authority (or by other legal persons controlled by that contracting authority).

- There is no private ownership involved.

Before recurring to any exemption to public procurement rules, Project Partners should assess carefully whether the contractual relationships they intend to enter fulfil the stringent conditions set by public procurement rules. FLC will check whether the requirements for in-house contracting have been fulfilled. In-house contracting can be eligible under condition that the related requirements set up also at national level are fulfilled. In-house should be limited to 50% of the budget of the concerned Project Partner and must be reported on a real cost basis. Public procurement rules foresee very limited and well-defined exceptions, among which the in-house contracting.

7.5.6.2 Market research

Project Partners who do not fulfil the definition of a contracting authority according to the relevant national procurement legislation (such as private companies or private associations) are normally not subject to public procurement law.

However, considering the EUI-IA projects are co-financed with public funds, and in order to demonstrate these funds are used in compliance with the principles of efficiency, economy and effectiveness, they must observe the basic principles of transparency, non-discrimination and equal treatment by complying with a specific requirement of market research.

When purchasing works, supplies or services, these Project Partners must ensure adequate market research by asking for at least 3 comparative offers, or presenting at least 3 internet quotes or prices for any contracts with a value higher than EUR 10 000 excluding VAT, and ensure thorough documentation for audit trail purposes and transparency of the decision-making process. In case the Project Partner must comply with other stricter rules (e.g. national, internal rules), these stricter rules apply.

In exceptional and duly justified cases, an exception to this market research principle can be accepted whenever the non-contracting Authority Project Partner can demonstrate an existing long-standing, reliable and cost-efficient relation with a specific provider. In that case, the audit trail should include a solid justification for the choice of the provider.

7.5.6.3 Most common procurement errors

Public procurement law is a complex matter and many findings during financial controls in European structural and investment financed projects are related to procurement errors.

Therefore, it is important that Project Partners are well aware of the public procurement rules which are applicable to them at all levels and act accordingly, paying special attention to avoid procurement errors. In case of doubts, Project Partners should contact the Permanent Secretariat or seek legal advice (from their legal department or external procurement experts).

The most common errors in European structural and investment funded projects are:

- Insufficient publication of procurement procedure (e.g. direct award without any prior notification, notification only on national or regional instead of EU level).

- Imprecise definition of the subject/matter of the contract to be awarded.

- Excessively short deadlines for the submission of tenders.

- Mix-up of selection and award criteria.

- Use of discriminatory or dissuasive selection or award criteria.

- Unlawful splitting of contracts.

- Use of wrong procurement procedure.

- Unlawful application of exemption rules.

- Unlawful negotiation during award procedure.

- Modification of a tender or criteria during evaluation.

- Unlawful substantial contract modification or purchase of additional works, services or supplies

7.5.6.4 Enforcement of procurement rules

For each Project Partner, the FLC checks inter alia if the applicable procurement rules have been respected.

Therefore, Project Partners must ensure that any procurement procedure is orderly carried out and documented. Failure to comply with the procurement requirements or to provide documentary proof of compliance with European, national, local and internal public procurement rules will lead to financial consequences.

If a procurement error is detected, the European Commission guidelines[11] will serve as a reference for determining possible financial corrections.

[8] For more information about EU Commission rules concerning public procurements, please consult: https://ec.europa.eu/growth/single-market/public-procurement_en

[9] As European procurement thresholds are updated on a regular basis, please always make sure the values referred to in the Guidance are still applicable at the time of your procurement procedure: https://ec.europa.eu/growth/single-market/public-procurement/legal-rules-and-implementation/thresholds_en

[10] Article 12 Directive (EU) No 2014/24/EU.

[11] Commission’s Decision No C (2019) 3452 of 14.05.2019

7.5.7 State aid

7.5.7.1 What is state aid?

According to Article 107 of the Treaty on the functioning of the European Union, the EU defines State aid as covering any measure involving a transfer of state/public resources which distorts competition (or threatens to) by favouring (i.e. conferring an advantage in any form whatsoever) upon certain undertakings (i.e. private or public entities offering goods and services on the market) on a selective basis, which is liable to distort competition and affect trade between Member States. State aid is also defined as an advantage in any form whatsoever conferred on a selective basis to undertakings by national public authorities[12].

A State aid risk is recognized whenever the 5 following conditions are met:

- The measure is granted to an undertaking: an “undertaking” is any entity engaged in an economic activity (e.g. offering goods and services on the market), regardless of its legal status, ownership and the way it is financed (they can be public bodies, non-governmental organisations or universities, as well as private firms). Even if the entity provides the goods or services free of charge or is financed entirely by the State, it could be subject to State aid rules. Also, even if an entity is not profit-oriented, State aid rules will apply as long as it competes with companies that are profit-oriented. Therefore, not only private companies are subject to State aid rules but also public authorities and bodies governed by public law as far as they carry out an economic activity on the market.

- Selectivity: State aid is selective and thus affects the balance between certain companies/market operators and their competitors. “Selectivity” is what differentiates State aid from the so called “general measures”, which apply without distinction to all enterprises, in all economic sectors, in a Member State (such as most nation-wide fiscal measures). Measures are selective if they apply only, or more advantageously, to some specific undertakings (or to some sectors, or to some regions) and not to all operators on the market.

- Transfer of State resources: State resources must be considered in the wide sense of any public resources. This includes EU (if under the control of the Member State authorities), national, regional or local public funds. It also includes those cases where public resources are granted by a private or public intermediate body on behalf of a public authority (for instance a private bank that is given the responsibility of managing a State funded aid scheme). State aid may take different forms: it is not limited to grants but it also includes interest rate rebates, loan guarantees, accelerated depreciation allowances, capital injections, tax breaks etc.

- Advantage: The measure must confer a benefit or advantage to an undertaking that would not have arisen in the normal course of business. Such an economic advantage can be assumed if the undertaking does not apply any market-driven consideration (e.g. it promises to create jobs in return for State funds received or it buys land from the State for a price lower than the market price). No such advantage is to be assumed if a private investor would have acted in the same way as the State when granting an advantage (e.g. a region participates in a company under the same conditions as a private investor would do).

- Effect on competition and trade:

- Distortion of competition: A measure granted by the State is considered to distort or threaten to distort competition when it is liable to improve the competitive position of the recipient or even to maintain a stronger competitive position compared to other undertakings with which it competes. This is generally found to exist when the State grants a financial advantage to an undertaking in a liberalised sector where there is, or could be, competition. The fact that the authorities assign a public service to an in-house provider does not as such exclude a possible distortion of competition.

- Effect on trade: Public support to undertakings constitutes State aid insofar as it affects trade between Member States or is liable to affect such trade. This happens where State financial aid strengthens the position of an undertaking as compared with other undertakings competing in intra-Union trade. A measure may be considered to have a purely local impact and consequently no effect on trade between Member States, when the beneficiary supplies goods or services to a limited area within a Member State and is unlikely to attract customers from other Member States, and that it cannot be foreseen that the measure would have more than a marginal effect on the conditions of cross border investments or establishment.

Care should be taken to ensure that funding of EUI-IA projects neither distorts competition nor leads to market interference without sufficient cause. In order to maintain a level playing field for all undertakings active in the internal market, EUI-IA projects involving economic activities (i.e. offering goods or services on the market) must be designed in accordance with State aid rules so as to ensure the effectiveness of public spending and prevent market distortions. At the time of project submission, the MUA will need to ensure that the project has been designed so as to comply with State aid rules at all levels, including to third parties (undertakings not included as Project Partners in the Project Partnership that receive an advantage through the project’s activities that they would not otherwise have received under normal market conditions). State aid compliance will be assessed on the basis of the activities to be undertaken Project Partners as described in the submitted Application Form.

7.5.7.2 How to comply?

Considering the nature of the EUI-IA projects, two criteria (selectivity and undue advantage) are deemed automatically met. Therefore, the EUI-IA State aid risk analysis focuses on the 3 other criteria:

- State resources;

- Economic activities;

- Effect on trade and competition.

EUI-IA is a centrally managed EU instrument, implemented through indirect management via an Entrusted Entity, the Région Hauts-de-France. The European Union budget finances the EUI-IA projects by the ERDF (up to 80% of the project's costs). These resources are not under the control of Member States but of the Commission and Entrusted entity. Consequently, the ERDF received by the Project Partner is not concerned by the State aid rules and is immune from State aid risk.

The Project Partner contribution (at least 20% of the project budget secured by the Project Partners) is covered by Project Partners’ private or public contributions. Therefore, only the contributions secured by each Project Partners as co-financing of EUI-IA projects may enter the scope of State aid rules, as far as public funding is involved and when conditions referred to in section 7.5.8.1 are met.

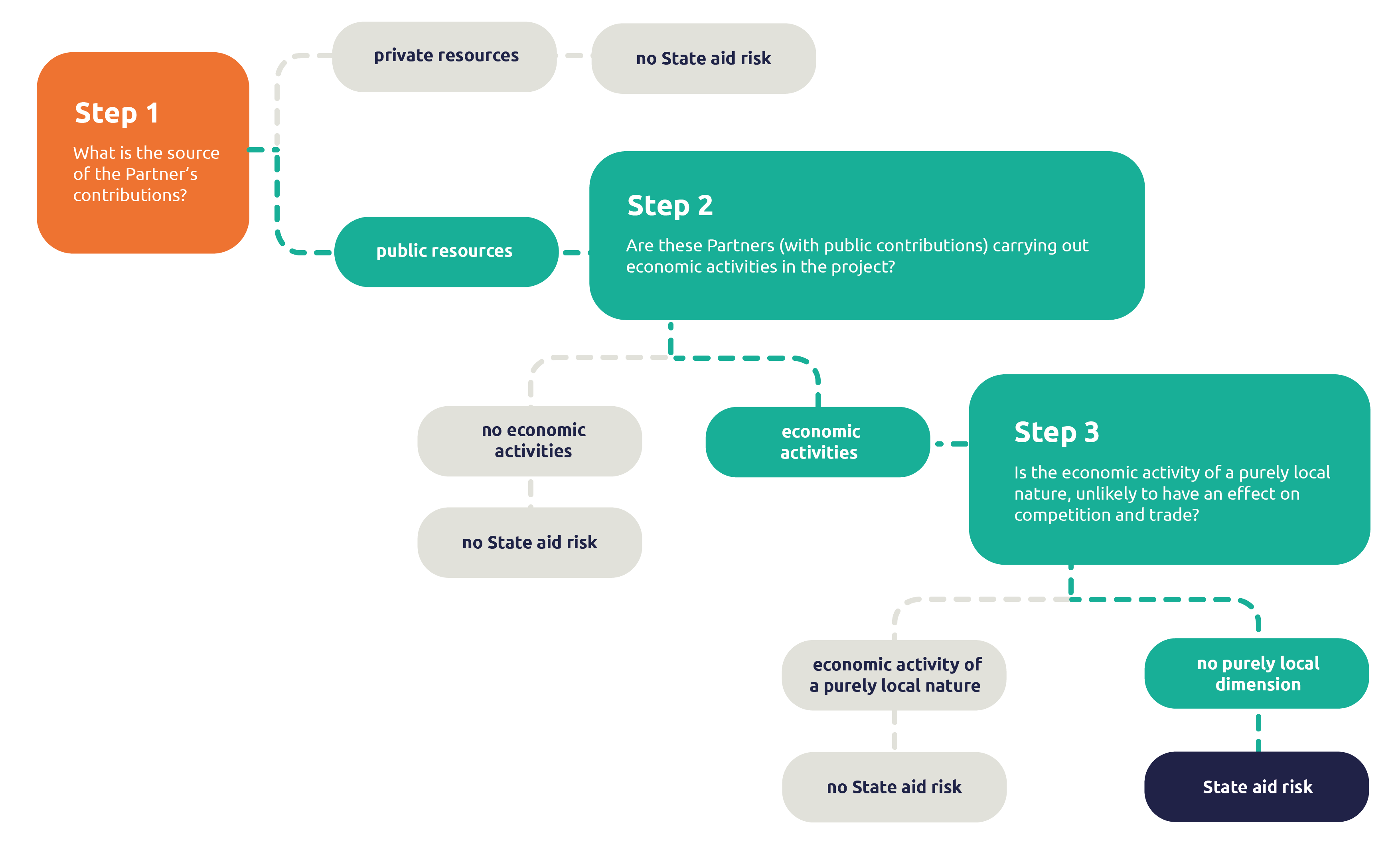

The scheme below (Figure 9) can be used to carry out a State aid self-assessment risk at Project Partner level:

Figure 10. State aid self-assessment scheme

If all 5 elements above are present, then the public support measure could be State aid, which may be compatible with the internal market or not. In such a case, the applicant should explore any/all of the below options according to a project's individual situation:

- Eliminate the State aid element by receiving national public contribution on market-conform terms.

- Eliminate State aid by meeting the de minimis requirements (up to EUR 200 000 per undertaking over 3 years)[13].

- Receive compatible and exempted from prior notification State aid by complying with the General Block Exemption Regulation[14].

- Receive compatible State aid based on the State aid regime applicable to service of general economic interest (SGEI)[15], it the project implanter has been entrusted with a genuine SGEI. In that case, the applicant would notably need to demonstrate the definition and entrustment of an SGEI, that the parameters of compensation have been established ex ante in a transparent manner and that the amount of compensation does not exceed the costs for the provision of the SGEI and a reasonable profit, as well as a claw back mechanism ensuring the absence of overcompensation.

- Receive compatible State aid based on a Commission decision, approving a scheme, individual or an ad hoc aid, previously notified by a Member State.

- Informally contact the National Competition Authority for advice or the European Commission (DG Competition), via pre-notification or submit an official notification to the European Commission (DG Competition)[16].

[12] For further guidance on the notion of State aid, see Commission Notice on the notion of State aid as referred to in Article 107(1) TFEU: http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52016XC0719(05)&from=EN.

[13] Commission Regulation (EU) No 1407/2013.

[14] Commission Regulation (EU) No 651/2014.

[15] Commission Decision 2012/21/EU.